11k students

11k students

15.9k students

15.9k students

14k students

14k students

19.8k students

19.8k students

17.4k students

17.4k students

11.5k students

11.5k students

12k students

12k students

14.5k students

14.5k students

14.6k students

14.6k students

16k students

16k students

14.6k students

14.6k students

12.8k students

12.8k students

11.7k students

11.7k students

16.6k students

16.6k students

18.9k students

18.9k students

13.4k students

13.4k students

14.2k students

14.2k students

13.4k students

13.4k students

16k students

16k students

15.6k students

15.6k students

10.2k students

10.2k students

10.3k students

10.3k students

19.2k students

19.2k students

12.3k students

12.3k students

10.7k students

10.7k students

17k students

17k students

16.9k students

16.9k students

13.4k students

13.4k students

16.9k students

16.9k students

20k students

20k students

10.4k students

10.4k students

17k students

17k students

12.5k students

12.5k students

16.4k students

16.4k students

17.6k students

17.6k students

13.8k students

13.8k students

15.8k students

15.8k students

10.8k students

10.8k students

10.5k students

10.5k students

13.4k students

13.4k students

18.6k students

18.6k students

18.1k students

18.1k students

17.3k students

17.3k students

Purchase Video Lectures & Books written by our famous expert CA Faculty.

The newly launched Mock Test Papers | Certified Copy Evaluation Program is launched to evaluate and guide the students on the Mock Test Papers and Certified Copies. Our Experts will guide you on the Mock Test Papers of the institute. Step wise marking and comments for each answer will be given. You can attempt the latest Mock Test Papers of the institute and get to know the marks and mistakes done in it. Also you can get your Certified Copies evaluated by our experts and know your shortcomings. Read more...

You need to register for the program on our website. The Fee structure to get one paper evaluated will be Rs 150 after discount. Checked sheets will be provided to you in 2-3 working days by our experts.

With the purchase of GM Test Series, you get a lot of additional benefits and features

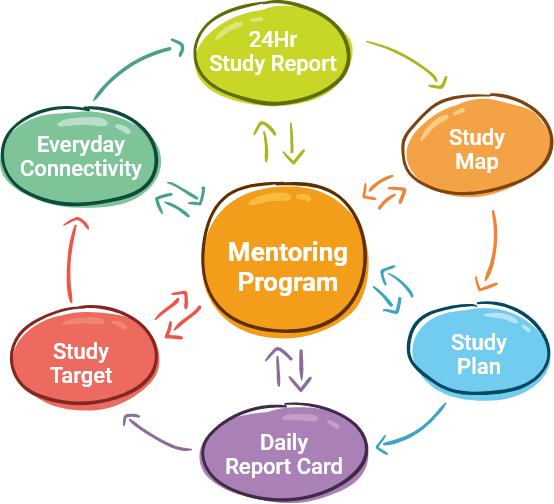

Join the Biggest Discussion Corner for Student and Professionals of

GM Test Series is proud to have more than 35 Rank Holders and has taught more than 63000 students in a short span of 5 years. We celebrate the success of our Rankers and all the other students and will keep motivating and helping our students achieve their dream of becoming successful professionals

Read Moregmtestseries.com is a unique platform for Conducting Online CA-IPCC / Inter and Final Test Series on PAN India Level. Most of the students are not able to find out the reason for getting low marks in CA Exams. So through this platform, we are providing detailed analysis of their performance and also guide them regarding tips for better preparation in their CA Exams. We are providing a platform to evaluate student’s performance prior to exams. Our team is concentrating on each student individually

Read MoreWe are glad to inform you that from previous trends, almost 50-55% Questions in ICAI Exams are same or similar Questions which our experts prepare for Test Series. After Attempting the Test Series Papers, students can easily figure out the Questions which are expected to be asked in CA Exams

Read MoreCA final test series provides coaching it additionally dispatches examination program for students to have satisfactory composed practice to confront the CA Examinations, as the understudies frequently confronted an issue of lacking practice to take up CA tests. To crush this trouble, we have presented a "CA FINAL TEST SERIES" wherein students have the choice to step through examinations either at master Institute or from home.

Read MoreDownload Sample Checked Sheets of Papers evaluated by gmtestseries.com team. This will give you an insight about how the Evaluation of CA Test Papers is done and what all things needs to be improved to score good marks in CA-IPCC / Inter and CA-Final exams. GM Test Series papers are prepared considering all the latest amendments and are prepared as per the recent amendments and updates. Check the Sample Checked Sheets of students and how comments and suggestions are given:

Check Sample SheetsAnswer these questions and GM Experts will guide you !!

Pave Your Way: Choose Your desired Course with GM Test Series.

Calling all future CA Test Series! Our state-of-the-art CA Test Series Nov 2023 will help you become ready to start your successful journey. Through this cutting-edge online platform, you can access thorough study resources that address the crucial areas of law, economics, taxation, and auditing. Prepare yourself as we empower you with the information and abilities to confidently pass the CA Executive examinations. With the best exam series by your side, get ready to leave your mark.

Notes: Amendment, Practice questions, MCQs and summary notes will be offered for assistance at each stage.

Toppers Sheets A topper sheet for each test and All India Ranking will be provided to each student.

Welcome to the ideal destination for your CA Final exam preparations! At our organisation, we know the significance of the CA Final test series Nov 2023 on your path towards becoming a Chartered Accountant. Moreover, we will equip you with specialist tips and advice to maximise your exam readiness and enhance your likelihood of passing. Discover more about this important CA Final Test Series by reading on!

Planner: An extensive study planner will be provided, which will assist you in revising the entire CA Final exam syllabus several times.

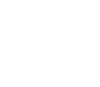

Individual guidance + Mentoring: Weekly and monthly goals will be offered to each student individually, along with customised guidance.

Comprehensive Evaluation: The CA Final test series May 2024 offers an extensive assessment of your knowledge and grasp of various accounting topics, ensuring you are well-prepared for the final test.

Real Exam Experience: The test series replicates the actual CA Final exam environment, enabling you to familiarise yourself with the layout, time constraints, and pressure, thereby improving your ability to perform effectively on the final day.

Get ready for the upcoming CA Intermediate (Inter) exams! Limited time remains for the May 2023 and Nov 2023 attempts. Adopt an organised research approach, splitting topics and establishing daily targets. Write and practice your changes diligently. Analyse errors and improve accordingly. Frequently attempt CA Inter Test Series Nov 2023 papers. Single group members have 24 tests, while both group participants have 48 tests. Every exam includes fresh, thought-provoking questions. Success awaits!

Comprehensive Coverage: The GM Test Series offers an in-depth examination of the exam syllabus, ensuring you are well-prepared for every one of the crucial subjects and concepts.

Accessible Anytime, Anywhere: The GM Test Series is accessible online, allowing you to take the tests anytime and anywhere, prov iding flexibility and convenience in your exam preparation.

Time Management Skills: The test series allows you to create effective time management skills as you pass the exam within specified time limits, allowing you to optimise your performance while finishing the test on time.

Performance Analysis: Detailed performance analysis and feedback offered after each test allow you to understand your progress, detect areas that need additional focus, and refine your exam strategy accordingly

Get prepared to conquer the CA Foundation Test Series Nov 2023 with us, your ultimate destination for preparation! This interactive test series will identify your desire for chartered accountancy and prepare you for exam success. The CA Foundation Test Series's May 2024 tips and tricks are revealed in our GM test series, and we show you how it can help you maximise your chances of passing the examinations. Prepare yourself for an incredible amount of sample papers, practice exams, and insider advice that will inspire you to exceed all goals and emerge victorious with brilliant hues of achievement!

Adaptive Learning: The GM Test Series uses personalised learning methods, adjusting the challenge stage and content based on your performance. This guarantees that you obtain specific suggestions for further study.

Experience personalised guidance that sets you up for achievement: With our continuous support, you will get essential feedback to guarantee you stay on track and optimise your exam preparation.

Identify Strengths and Weaknesses: By taking part in the test series, you can determine your strengths and weaknesses across various subjects, allowing you to concentrate on areas requiring enhancement and fine-tuning.

Increased Probability of Success: By taking part in the CA Foundation test series, you significantly boost the likelihood of success in the final examination, as it improves your skills, boosts your confidence, and maximises your exam preparation.

Gear up for achievement in the difficult CS Exam test series! As you know, it's difficult, particularly if you rely solely on books for your studies. But worry not! The change that you require is the CA Exam Test Series

Nov 2023. This outstanding series aims to bridge the gap, offering you the complete knowledge and insight required to conquer the exam. It covers important topics like tax laws, business accounting, auditing, and assurance.

Detailed Suggested Answer: Suggested answers will be provided for each test paper covering stepwise points.

Live Tests: Live MCQ tests will also be provided in all the plans to judge performance quickly.

Expertly Designed Questions: The test series involves expertly designed questions that challenge your understanding and expertise, helping you improve your problem-solving skills and critical thinking abilities.

Realistic Exam Experience: The test series replicates the actual exam environment, giving you an accurate representation of the exam format, time constraints, and difficulty level, thus preparing you efficiently for the real exam.

Step 1: Begin your journey - Download the Test Post Registration

Step 2: Motivate Your Mind - Answer Questions on Your Trusted Notebook

Step 3: Capture Brilliance - Sequentially Photograph or Scan Your Pages

Step 4: Seamless Integration - Upload Your Sheets as PDF or Page by Page on Our User-Friendly Portal

Step 5: Guided Evaluation - Expert Mentors Analyse Your Performance

Step 6: Illuminate Your Progress - Receive Checked Sheets, Rankings, and Personalised Suggestions in Just 1-2 Days!

Contact Us Today!

Are you prepared to advance your CA career? Look no further! We at GM Test Series are committed to giving you the excellent CA Mock Test Series, education, and training available. Whether you're an experienced professional looking to enhance your skills, we have the right programs and resources to propel you toward success!